Four steps to remove yourself from the federal tax system.

Note: The following 4 steps are specific to the situation of one individual. It is dependent upon the type of organization, where the company is located and how the individual is set up to work for them. If your situation is different than the criteria listed below, then the following process may be different for you. The difference may include the use of different forms or the final outcome of this process may be different.

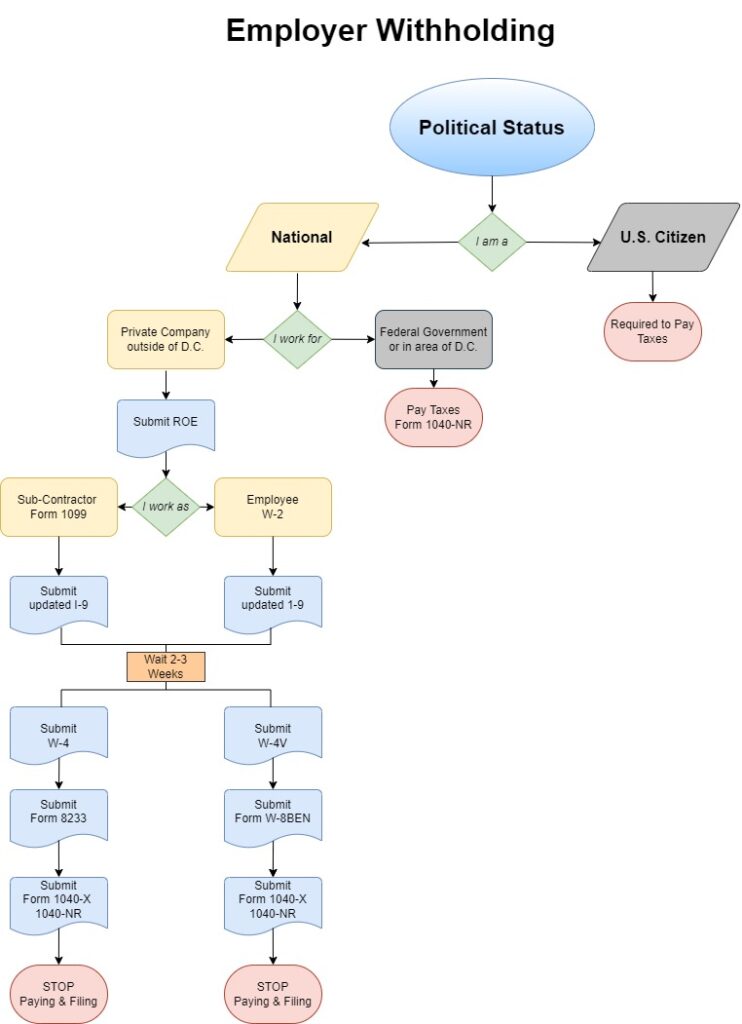

This process applies to an individual that meets the following criteria, see the flowchart below.

- You are an established national, consistent to a nonresident alien as defined by the IRS.

- You are an employee Form W-2, not a contractor Form 1099.

- You work for a private employer. You do not work directly for the U.S. federal government or within the boundaries of the District of Columbia [26 C.F.R. § 871(b) & 877(b)].

STEP ONE: Revocation of Election

The Revocation of Election is a document that notifies the IRS that you are cancelling your contract in which you elected to pay them a federal income tax. This contract was initiated the first time that you filed a Form 1040. This may have occurred years ago when you filed your first 1040 on the wages of your first job.

Essentially, you’re opting out of your voluntary election to pay federal income tax. In addition, the Revocation of Election reiterates that you’re a nonresident alien. The IRS has already been made aware of your status as a national, because you already mailed them your affidavit in the Notices step. If you recall, your Affidavit of Citizenship Evidence that was previously sent in the notice, made reference that the definition of a national is consistent with the IRS definition of a nonresident alien. Below, in addition to a sample Revocation of Election document, is a sample cover letter to include with the mailing to the IRS.

Don’t forget that the Revocation of Election document must be signed and notarized before mailing to the IRS.

The mailing address is:

Internal Revenue Service

2970 Market Street

Philadelphia, Pennsylvania, 19104-5016

The documents to include in the mailing with your Revocation of Election document are:

- Revocation of Election and it’s cover letter.

- Copy of your Affidavit of Citizenship Evidence and it’s cover letter.

ROE Package Builder

Complete the following form to build the Revocation of Election Package. We will email the ROE and it’s cover letter to you. There will be a link to an editor, should you need to modify your documents. Please review our Privacy Policy.

STEP TWO: IRS Form I-9

Update your I-9 with your employer

The I-9 is an official IRS form which provides your employer or potential employer the information they need to verify your identity and employment eligibility. If you’re already employed rather than in the process of being hired, you can still utilize and update your employment eligibility with the employer. Normally, an I-9 is utilized with an employee at the time of hire or to verify eligibility before hiring.

First complete all the demographic information at the top of the form as directed in the instructions. You’ll notice that the I-9 provides 4 choices to select from in attesting to your citizenship. None of which are consistent with a national.

In the following example I-9 form, select #2- A noncitizen national of the United States. As you already know, this is not a national, but this selection can be used for the purposes of the form and will be explained in the Letter of Explanation that you’ll include with the I-9 to your employer.

Do not forget to sign and date the form.

Submit the completed I-9 to your employer. Do not file or submit the I-9 to the IRS. It will be submitted to your employer, along with additional documents mentioned below.

Attached documents to the I-9 Form

1. Letter of Explanation

- You will be attaching a Letter of Explanation to the I-9 form, that will explain your selection of noncitizen national of the United States rather than a national. It will also explain what a national is and where to find the definition. Also, it explains to your employer that you’re now a nonresident alien, which is consistent with a national and is the term that the IRS uses for a national. The importance of this will come into play later in this process when you submit additional IRS forms to your employers.

- Follow this sample to write your own Letter of Explanation.

2. Copy of your Affidavit of Citizenship Evidence and Cover Letter

- These two documents are referenced in your Letter of Explanation.

3. Copy of your E-Verify verification

- E-Verify is the system that many, if not most, employers use to verify the eligibility of individuals to work. They use it to check potential new hires, as well as, to verify the status of current employees. When employers check the eligibility status of a potential or current employee in E-Verify, the system will authorize or not authorize the individual to work. The system is actually checking the individuals eligibility with the Department of Homeland Security and the Social Security Administration.

- Signup or login to E-Verify at the following link: https://www.e-verify.gov/employees/employee-self-services/mye-verify Note: You must first create an account on E-Verify before you can perform a self-check on MyE-Verify.

- The E-Verify system provides the ability for individuals to do a self-check via a section of their website called MyE-Verify. An individual can create an account and then login to do the self-check. Remember, by performing a self-check and including the printout from the myE-Verify you will be providing your employer the confirmation they need before they do a check. They most likely will do their own check anyway, but you’ll now be aware of what your status is.

- As with most government websites or forms, the choice for you to select your citizenship does not include a national. The choice you will select in MyE-Verify is the noncitizen national and it is critical to use your passport book or card number of the passport you received after you submitted your Affidavit of Citizenship Evidence to the U.S. Secretary of State. This passport number will connect your citizenship to that of a national, despite selecting noncitizen national in MyE-Verify.

Once you have successfully performed the MyE-Verify self-check, include the printout (example below) to your I-9 form that you’ll be submitting to your employer.

4. Printout of the Department of State website page

- Adding this page will ensure that your employer is being provided the official definition of a national illustrated directly on the U.S. Department of State website. They may not completely, or may not at all, understand what a national is, but you’ve provided them the source information to do their own research if they wish.

Below is the list of the documents to submit with your completed I-9 form.

- Letter of Explanation.

- Copy of the Affidavit of Citizenship Evidence and its cover letter that you sent to U.S. Secretary of State.

- Copy of the printout of the, You’re authorized to Work! page from the myE-Verify self-check that you completed online.

- Printout of the Department of State website page, Definition of a national.

More information on how to fill out the I-9 form:

I-9 Explanation Letter Builder

If you would like help with your Letter of Explanation for your I-9, complete this form. The letter will be emailed to you with a link to tools for editing, if needed. Please review our Privacy Policy before using any of our forms.

STEP THREE: Forms W-4V & W-8BEN

These two forms can be submitted to your employer at the same time.

- IRS Form W-4V is used by an individual to notify his employer that he would like to change the amount of Federal Income Tax withholding.

- IRS Form W-8BEN is used to notify your employer that you are an exempt Beneficial Owner of the income/wages that you earned from your employer. It also notifies your employer that you’re a nonresident alien.

Employers are also required to match your withholdings, so actually they may have an incentive to stop withholding because they will no longer have to match it. Be patient with them and help educate them. They are probably more fearful of the IRS than their employees. Bottom line though, they cannot refuse to accept these forms from you and must abide by your wishes to stop withholding. They will most likely submit the form immediately to the IRS or when the IRS inquires as why withholding has discontinued on your wages. Ideally, the IRS should not question the employer at this point because you have officially already noticed the IRS and sent them your Revocation of Election.

Are the forms W-8BEN or the W-4V not being accepted by your employer? The following sample letter and may help. The videos will also provide guidance:

More video resources from Joe Lustica on Rumble:

Forms W-4V, W-8BEN, W-8BEN-E, 1040-NR

How to fill out the W-8BEN form

Getting the W8-BEN accepted by your job

Your W8-BEN will be taken now

How to fill out the W-4V form

STEP FOUR: Form 1040-X and 1040-NR

Now you’re ready to contact the IRS for the return of the last 3 years of federal income tax funds that they have withheld from you, via collection of withholding from your wages by your employer.

There is an IRS process to amend the last 3 years of your returns that will elicit the return of your federal tax withholdings for those tax years. They require two IRS forms (1040-X and 1040-NR) and your previously filed tax returns to complete this process.

FORM 1040-X

The first IRS form needed is the Form 1040-X which is used to explain the reason you’re submitting this form to amend a previous return. Once the reason is documented on the 1040-X, it is then attached to a completed 1040-NR form.

More on the 1040-X form:

FORM 1040-NR

The second IRS form needed, the 1040-NR, will document the amount of relevant income that is exempt from federal taxation and the amount of withholding that you want refunded to you. Don’t forget to write “Amended Return” at the top of the form.

PREVIOUSLY FILED RETURN

Finally, the third and last IRS form you’ll need will be a copy of the previous return that you are replacing or amending with the new 1040-NR form. The totals of the income and withholdings should correlate between the previous return and the new 1040-NR return. Don’t forget to write “Previously Filed Return” at the top of the form.

- If you’re in the middle or at the end of a tax year for the final 3rd year and you have not yet completed a tax return, you’ll still need to file a 1040-NR to have any federal tax withholdings returned to you that has been withheld up to that date for the current tax year. In this situation, the 1040-NR (and a copy of a current pay stub or W-2) is all that is needed and will be used to substantiate an individual’s nonresident alien status and to provide the relevant income and withholding amounts. Ideally as a nonresident alien, unless any additional federal taxes are withheld or you work directly for the federal government or in the geographical area of the District of Columbia, it will no longer be necessary to file a federal tax return.

- Best of all, by completing Step Four of the Internal Revenue Service section, you have finally fully removed yourself and any connection to the U.S. Federal Tax system. Congratulations!

SUCCESS!

The entire amount of federal tax withholding for the most currently ended tax year (2023) has been approved for refund for this writer (see screenshot of the refund approval below). For this year, all that was needed to file was the completed 1040-NR and a copy of the most current pay stub or the W-2 for 2023, if it was available. No other filing had been submitted for that tax year, so there was no need to amend a previously filed return.

This is very exciting news as this approval of the refund of the full amount of federal tax withholding validates and confirms that the IRS has accepted and acknowledged all previously submitted documentation related to establishing oneself as a nonresident alien aka a national. With this acknowledgement, it also indicates that as a nonresident alien, federal tax will no longer be withheld unless the nonresident alien works directly for the U.S. or works within the geographical area of the district of columbia.

- Lawful Legal Notice of citizenship evidence

- Revocation of Election

- W-8BEN

- Request for return of 2023 Federal Income Tax Withholding

- 2023 1040-NR and W-2

- A summary of reference material

- Copy of Passport Book, Passport Card

BOTTOM LINE….this process worked, but you MUST read carefully and understand that not everyone’s situation is the same.

Final Notes

Now that you’ve completed all the steps in the IRS section, you are no longer required to file a federal tax return with the federal government.

- When mailing documents of this importance it is wise to use Certified Mail, Return Receipt Requested.

- Be sure to keep all copies of your return mailing receipts in a safe location.

- If you’re emailing any of these documents to your employer, you may want to set the your email up for a delivery and read receipt.

- If you’re handing documents directly to your employer or to the IRS at a local service office be sure to have the documents initialed by them and get a copy to take for your records. This will allow you to verify, if needed, that you’ve submitted these documents.

- Take a look at the Internal Revenue Code of 1954; 26 CFR 1.1-1(a)

FAQ’s

What type of identification do I need to send to the IRS?

They will need your first name, last name and the last four digits of your social security number.

What is a CP-59 notice

CP-59 is a notice issued by the Internal Revenue Service (IRS) to taxpayers who have failed to file their prior year personal tax return. The notice is sent to individuals who have not filed their tax return, and the IRS believes they owe taxes.

What the Notice Means

The CP-59 notice is a compliance alert, which means the IRS is driving tax compliance in high-income individuals by sending these notices. The notice states that the IRS believes the taxpayer has not filed an individual income tax return, and they may be subject to penalties and interest.

Consequences of Not Filing

If you receive a CP-59 notice, it’s essential to take immediate action. Failure to file your tax return can result in penalties and interest. The failure-to-file penalty is 5% of the amount owed per month, capped at 25% of the tax bill. Additionally, there’s an interest-based penalty based on the current interest rate.

What to Do

If you receive a CP-59 notice, you should:

- File your tax return as soon as possible

- Pay any owed taxes and penalties

- Contact the IRS if you have any questions or concerns

It’s crucial to address the CP-59 notice promptly to avoid further penalties and interest.

How long did it take to hear back from them on your 1040-X and 1040-NR?

It was approximately six weeks.

Should I go to the local IRS office and have my forms signed before submitting to my employer?

From our experience, we do not advise this. The folks who work in the local IRS offices are not going to understand what you are asking them to do. They are there to collect funds from people who owe the IRS. They will not assist you with any paperwork. If you have questions, please use the forums on this website or the comments section found at the bottom of this page.

Where’s My Refund?

Haven’t heard back about your 1040 NR you filed “manually” on April 15th. Try this link https://www.irs.gov/wheres-my-refund.

You will need:

- Your Social Security or individual taxpayer ID number (ITIN)

- Your filing status

- The exact refund amount on your return

If you’d like assistance with the process, we can help.

IRS forms are overwhelming. Having someone personally guide you through the steps will relieve the stress.

Mark Mayes is now offering his professional services to assist nationals with completing the steps to remove themselves from the IRS federal income tax system.

To start working with Mark, just complete this form and he will be in touch with you soon.

17 thoughts on “Internal Revenue Service”

Leave a Reply

You must be logged in to post a comment.

Hi David,

Attempting to the paperwork for employment. I am a subcontractor.

The question right now is about the ROE. The 1 you have here, can it be used to send to the IRS and if so does it matter that it says He and not She or he/she, his/hers?

I will have more questions but 1 at a time right now.

Thank you in advance!

Tess

Hi Tess,

Sorry just getting back to you. Have you completed all the prerequisite steps indicated on the site required to garner your national status…such as the affidavit, notices and passport process? Also, in my opinion, the ROE, should completed and in the hands of the IRS prior to submitting the forms to the company you work for. But, as a 1099, you’re handling your own tax withholdings anyway. I’m not really as familiar with the 1099 process as I am with stopping withholdings for W-2 employees. Remember though that we’ve tried to follow a step-by-step process for most of the items in the Remedy section of the site and the steps are sequential. As for using he or she in the ROE, my perspective is that it should reflect your birth gender. As with the ROE, you should also be doing your own vetting and research of the contents and grammer of the documents you use. It’s your signature that will be on the documents. I encourage you and others to add additional comments here. Thanks and keep up the hard work towards your freedom.

David

Hello all.

We sent new I-9s and are getting our W4Vs and W8BENs ready.

The sample letter to send with the 2 forms (and at least one of Joe’s videos) says to quote from the anti-discrimination notice on the I-9.

Doesn’t that apply only to the I-9 and not necessarily to the W8BEN and W4V?

Yes, anti-discrimination is against the law, but it seems this quote is being used to tell (employers) they have to accept any forms submitted.

We may want to use other references to anti-discrimination rather than using the I-9 statement as it seems to apply to that form specifically.

Any thoughts on this? (Not here to argue/nitpick, just want to clarify.)

My take in regards to stating an anti-discrimination statement to an employer is only relevant or indicated if there is pushback from the employer in accepting any of the forms in general. Perhaps the statement you’re referencing is specific to the I-9, but from what I understand a claim of discrimination may apply if any of the forms are not accepted. I believe there is a more extensive, full letter regarding discrimination available on the site if needed. Basically, they must accept your forms, but if they don’t the recourse could potentially be a complaint to the IRS and/or a claim of discrimination based on your status as a national. My understanding is that they are just supposed to ensure the forms are completed appropriately…all necessary fields are filled in like name, address, etc. and it’s signed. Btw, the letter I mentioned can be found in STEP THREE of IRS section of Remedy area of the site.

Thanks David!

David, one more question. Did you send your tax forms via certified mail as well?

Yes, I send all my stuff via certified mail.